Exploring Social Media Internet Marketing Trends for Consumer Brands in 2025

The realm of social media marketing is constantly evolving, with trends shifting and new strategies emerging to capture consumer attention and drive brand engagement. As we look ahead to 2025, it is essential for consumer brands to stay abreast of the latest trends in social media internet marketing to remain competitive and effectively connect with their target audience. Let’s delve into some of the anticipated trends that are likely to shape social media marketing for consumer brands in 2025:

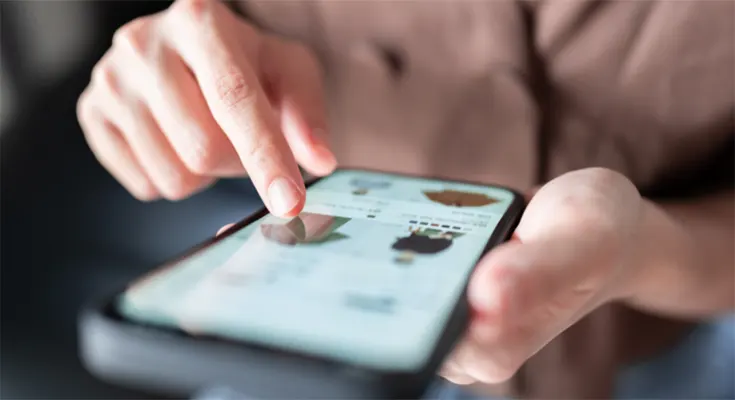

1. Augmented Reality (AR) Experiences

Augmented Reality (AR) technology is poised to revolutionize social media marketing for consumer brands in 2025. By integrating AR experiences into their social media campaigns, brands can offer interactive and immersive content that engages users in unique ways. From virtual try-on experiences to AR-powered product demonstrations, brands can leverage AR to enhance consumer engagement and drive conversions.

2. Influencer Marketing Evolution

Influencer marketing will continue to …

Exploring Social Media Internet Marketing Trends for Consumer Brands in 2025 Read More